Hapag-Lloyd Discharges Fire-Damaged Yantian Express Containers

All Yantian Express containers affected by the fire have been discharged from the vessel, German shipping company Hapag-Lloyd informed.

Specifically, offloaded were boxes in the fire impacted areas in way of cargo holds 1 and 2 – on and under deck.

The company is currently working on a solution to transship these containers which cannot be reloaded back on the vessel.

In addition, the company is still searching for a terminal where it could offload the undamaged containers.

“Presently, the plan is for the balance of the undamaged cargo to remain on board the Yantian Express, which will depart Freeport once needed repairs are finalized,” Hapag-Lloyd said in its latest update.

“The final port of call for the vessel is still to be nominated,” the company added.

As World Maritime News earlier reported, the 7,506 TEU containership suffered a fire in the North Atlantic, around 650 nautical miles off the Canadian coast on January 4. After the fire increased in its intensity, the ship’s crew members were evacuated two days later.

In February, the 2002-built boxship berthed in Freeport, Bahamas, to undergo the evaluation process and prepare for cargo discharge. Around 200 containers have been identified as a total loss.

Asia-Europe trade presents huge challenges for carriers

Headwinds include Brexit, a U.S.-China trade deal and the International Maritime Organization's 2020 sulfur cap.

Carriers have been dealing with a weak container shipping market across major east-west trades in recent months despite becoming increasingly aggressive about limiting capacity, but going forward, carriers can expect the Asia-North Europe trade in particular to give them a run for their money.

Uncertainty continues to loom over the entire container shipping industry, from an unclear Brexit outcome to question marks still hanging over a potential U.S.-China trade deal and, most importantly, the International Maritime Organization’s (IMO) 2020 sulfur cap. After all, it is still not clear just how much cost carriers will absorb from higher fuel prices due to the regulation, especially considering the little luck they have had in the past in passing down higher fuel prices to shippers.

Carriers blanked more sailings than usual on Asia-North America and Asia-Europe trades around the 2019 Chinese New Year, which began Feb. 5 this year, and have continued to be aggressive in blanking sailings on both trades.

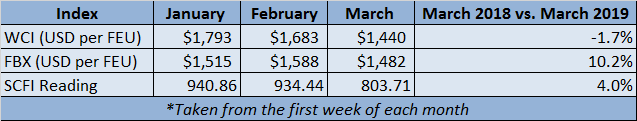

However, spot container rates generally have continued to tumble in recent months, according to composite readings of the Shanghai Shipping Exchange’s Shanghai Containerized Freight Index (SCFI), Drewry’s World Container Index (WCI) and the Freightos Baltic Index (FBX). Despite all three indexes showing a downturn in recent months, they show mixed results on a year-over-year basis as of early March, as illustrated in the chart below.

Since the beginning of March, all three indexes have continued to further decline week-over-week, with the WCI standing at $1,293 per FEU as of March 21, the FBX at $1,280 per FEU as of March 22 and the SCFI at 727.88 as of March 22.

The WCI is a composite of container spot rates on eight major routes to and from the United States, Europe and Asia; the FBX is a composite of container spot rates on 12 global routes between Asia, Europe, North America and South America; and the SCFI measures container spot rates from Shanghai to 13 regions around to globe to give an overall reading.

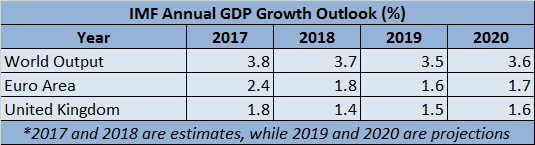

Bearing the brunt. Despite the current downturn for container carriers, coupled with higher than usual uncertainty, one factor that is for sure is that the Asia-North Europe trade, in both directions, will be a challenging area for carriers to make a profit for an array of reasons, but particularly because North Europe is experiencing slower economic growth than the world average.

The chart below illustrates that the International Monetary Fund’s (IMF) latest world economic outlook projections released in January forecast global growth remaining relatively stable each year between 2017 and 2020. However, growth in the euro area took a sharp downturn between 2017 and 2018, according to IMF estimates. Meanwhile, the United Kingdom’s global growth, which the IMF admitted is highly uncertain and dependent on the Brexit outcome, is expected to total 1.5 percent this year. The IMF had said its projection for the U.K. was based on a scenario in which a Brexit deal is reached in 2019 and that the U.K. “transitions gradually to the new regime.”

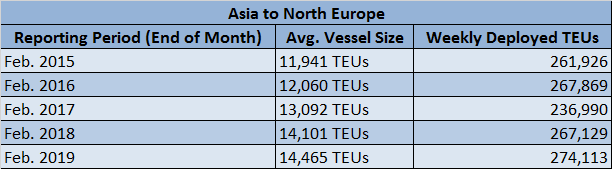

Despite generally weak rates on the Asia-North Europe trade, average containership size on the trade continues to increase, as illustrated in the chart below, which was built using BlueWater Reporting data. As of the end of February, average containership size on the trade totaled 14,465 TEUs, up 21.1 percent from four years prior, but only a modest increase of 2.6 percent from a year prior.

“Since 2011, the compound annual growth rate on the westbound Asia-North Europe trade is a miserable 1.3 percent, which looks worse when considering the huge capital investment made to upgrade the route with ultra-large container vessels (ULCVs) of 18,000 TEUs and above,” shipping research and consulting firm Drewry said in its March 3 Container Insight Weekly newsletter.

A glimmer of hope? Despite the Asia-North Europe trade being a challenging market for carriers, there are some signs that carriers are taking measures on the trade to reverse this trend and thwart overcapacity issues.

Drewry said that carriers, for the first time, are phasing some of the ULCVs from the Asia-North Europe trade onto the Asia-Middle East and Asia-Mediterranean trades. Drewry said the OCEAN Alliance’s ME5 loop and the 2M Alliance’s AE11/Jade loop are seeing some of these ULCVs.

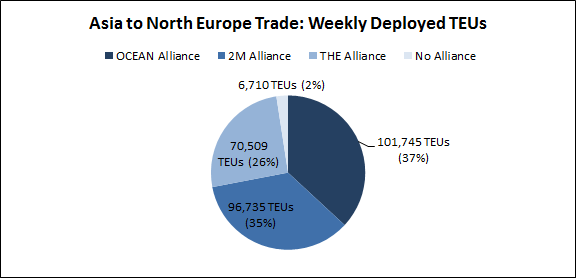

Ironically, the OCEAN Alliance, which BlueWater Reporting shows deploys the most capacity on the Asia to North Europe trade, is slated to launch a seventh loop to the trade as part of its new service network that takes effect in April. However, none of the OCEAN Alliance’s members would provide comment on how much this seventh loop will increase its capacity on the trade.

The chart above, built using data from BlueWater Reporting, shows each alliance’s current presence on the Asia to North Europe trade, based on weekly deployed capacity (TEUs).

In addition to moving ULCVs from this key trade to other routes and being more aggressive in blanking sailings, it also appears that the era of trying to be the latest carrier to order the largest vessel is coming to an end. Carriers instead are more focused on branching out to offer other logistics services and preparing for the IMO’s sulfur cap.

Clarksons said in March that containership capacity expansion totaled 5.6 percent in 2018 and is expected to total around 3 percent in both 2019 and 2020.

“On the supply side, despite a steady flow of feeder ship ordering, at an aggregate level, the ordering of newbuildings remained relatively moderate with 1.2 million TEUs contracted in 2018; the orderbook now stands at a historically low 13 percent of fleet capacity,” Clarksons said. “Liner company consolidation has continued, and for operators and owners alike, fuel economics are now firmly in play.”

Although carriers have taken measures to restrict capacity, the outlook for carriers on the route still appears generally grim as these steps don’t change Europe’s economic downturn and the fact that the trade will be especially hit hard from the sulfur cap. And although ocean-going vessels transport the vast majority of cargo on the trade and will continue to do so, overland transport is on the rise.

Going forward, carriers will want to continue to be aggressive about blanking sailings on the trade to help with overcapacity and potentially slow steam more to save money on fuel costs, while shippers will want to pay close attention to these measures, which could delay their shipments. But at least they can capitalize off of the trade’s low spot rates for the time being.

COSCO Shipping Lines Seals LSFO Supply Deal

China’s COSCO Shipping Lines has signed a low sulfur fuel oil (LSFO) supply agreement with Double Rich Limited, a subsidiary of China Marine Bunker (Petro China).

According to the agreement inked on March 28, 2019, Double Rich limited will provide fuel oil with sulfur content not exceeding 0.5% m/m for COSCO Shipping Lines’ vessels.

As explained, this would enable COSCO “to better fulfill the amendment of ANNEX VI in International Convention for the Prevention of Pollution from Ships (MARPOL), which has been adopted by IMO.”

By promoting and applying diverse emission reduction technologies and optimizing management pattern, COSCO is moving forward to realize green shipping. The LSFO supply deal has been described by the company as an important step towards “actively fulfilling MARPOL of IMO, confronting industry trends and adhering to green development.”

Preparing for the IMO 2020, the company has implemented research, development and application of ship desulfurization technology. On the basis of pilot installation of scrubbers on two vessels, COSCO Shipping Lines plans to equip more vessels with scrubbers.

COSCO added it intends, also in the future, to “fulfill international conventions and practice green concept by cooperating with partners and global major fuel suppliers.”

OOCL parent company reports smaller profit in 2018

OOIL reported a profit attributable to equity holders of $108.2 million in 2018 compared to $137.7 million the previous year despite higher operating profits and revenues.

Orient Overseas International Ltd. (OOIL), the parent company of container carrier Orient Overseas Container Line (OOCL), reported Monday a profit attributable to equity holders of $108.2 million in 2018, which was about $30 million less than the $137.7 million reported in 2017.

OOIL reported an operating profit of $262.94 million on revenues of $6.57 billion in 2018, compared to $238.16 of operating profit on $5.98 billion in revenues in 2017. Compared to 2017, the Hong Kong-based company in 2018 had more than $100 million in additional business and administrative expenses ($550.73 million), nearly $46 million more in finance costs ($143.2 million) and about $46 million more in taxation ($58.62 million), but it made $32.72 million from discontinued operations in 2018 compared to an almost $10 million loss the previous year. Orient Overseas International Ltd. (OOIL), the parent company of container carrier Orient Overseas Container Line (OOCL), reported Monday a profit attributable to equity holders of $108.2 million in 2018, which was about $30 million less than the $137.7 million reported in 2017.

OOIL reported an operating profit of $262.94 million on revenues of $6.57 billion in 2018, compared to $238.16 of operating profit on $5.98 billion in revenues in 2017. Compared to 2017, the Hong Kong-based company in 2018 had more than $100 million in additional business and administrative expenses ($550.73 million), nearly $46 million more in finance costs ($143.2 million) and about $46 million more in taxation ($58.62 million), but it made $32.72 million from discontinued operations in 2018 compared to an almost $10 million loss the previous year.

OOIL said 2018 was another “year of strong growth for OOCL, especially in the Asia-Europe and transpacific trades.” OOCL’s liftings increased 14.5 percent on Asia-Europe, marking the second straight year of double-digit growth, and 8.9 percent on transpacific. The growth of both trade lanes outpaced the volume growth seen in the market as a whole for the second straight year, OOIL said.

Challenges include a slowdown of the global economy, uncertainties facing shipping, such as trade frictions and oil prices, and the industry’s supply and demand imbalance. Positive factors include the stability of China’s economic growth factors and the slowdown of container shipping’s capacity growth, which may help alleviate pressure on the supply side.

“In the new year, OOIL, as an integral part of the container shipping business of China COSCO SHIPPING Group, will, together with parties from various fields, continue to work proactively and diligently, constantly improving development quality, offering customers ever-improving services and creating greater value for our shareholders,” the company said.

A.P. Moller – Maersk to retain full ownership of Maersk Supply Service

The A.P. Moller – Maersk Board of Directors has decided to retain full ownership of Maersk Supply Service.

The offshore support vessel industry, which Maersk Supply Service operates within, has over the last three years exhibited clear signs of distress, reducing company market capitalisations and lower asset values, negatively impacting the ability to find a sustainable ownership structure for Maersk Supply Service outside of A.P. Moller - Maersk. The industry continues to be characterised by oversupply, financial restructurings and consolidation and the market outlook for the industry is expected to remain subdued in the near and mid-term.

“We have over the past two years been investigating various structural solutions for Maersk Supply Service. However, having been unable to establish any solutions meeting our objective of creating shareholder value, we have decided to retain Maersk Supply Service,” says Claus V. Hemmingsen, Vice CEO of A.P. Moller – Maersk.

Maersk Supply Service has the last two years been progressing towards becoming a stand-alone entity and today operates almost fully independently and will continue to do so.

Maersk Supply Service was classified as discontinued operation and held as asset for sale in Q4 2017. The company will be reclassified to continuing operations and will be included in A.P. Moller – Maersk’s income statement, balance sheet and cash flow statement as part of the segment Manufacturing and Others. The reclassification of Maersk Supply Service will not affect A.P. Moller – Maersk’s guidance for 2019, as announced on 21 February 2019.

For the financial year 2018 Maersk Supply Service reported a revenue of USD 263m and an EBITDA of USD 3m with a negative free cash flow (FCF) of USD -316m due to the payment of four newbuildings. At the end of 2018 the Invested capital was USD 714m following a negative fair value adjustment of USD 400m recognized in Q3 2018. For 2019 the expectations are an EBITDA close to break-even level and a negative FCF of around USD -200m due to delivery of the remaining newbuildings ordered in 2014.

Cosco Shipping Lines- Green shipping boost environmental protection

COSCO SHIPPING LINES signed LSFO supply agreement with Double Rich Limited on 28th of March, 2019. According to the agreement, Double Rich limited will provide fuel oil with sulfur content not exceeding 0.5% m/m conforming to the regulation of International Maritime Organization (IMO) for COSCO SHIPPING LINES in order to assist the fleets of COSCO SHIPPING LINES to better fulfill the amendment of ANNEX VI in International Convention for the Prevention of Pollution from Ships (MARPOL), which has been adopted by IMO.

By keeping promoting and applying diverse and advanced emission reduction technology and optimizing management pattern, COSCO SHIPPING LINES will try their best to push forward to realize GREEN SHIPPING. Signing the LSFO supply agreement is an important measure of COSCO SHIPPING LINES actively fulfilling MARPOL of IMO, initiatively confronting industry trends and adhering to GREEN development. Facing MARPOL 2020 regulation to be taken effected, COSCO SHIPPING LINES actively prepares and achieves LSFO resource by multi-sourcing. Meanwhile, COSCO SHIPPING LINES closely follows main stream market and implements the research, development and application of ship desulfurization technology. On the basis of pilot installation of scrubbers for 2 vessels, more vessels will be further promoted to install scrubbers. In the future, COSCO SHIPPINGS will comprehensively fulfill international conventions and practice GREEN concept by cooperating with partners and global major fuel supplier sulfurization technology. On the basis of pilot installation of scrubbers for 2 vessels, more vessels will be further promoted to install scrubbers. In the future, COSCO SHIPPINGS will comprehensively fulfill international conventions and practice GREEN concept by cooperating with partners and global major fuel suppliers.

Hapag-Lloyd aims to increase profitability, deleverage

The fifth-largest container carrier wants to be “number one for quality” and increase digital initiatives.

Hapag-Lloyd expects to increase profitability and further deleverage the company in 2019, said Rolf Habben Jansen, the company’s chief executive officer, last week in a telephone call with securities analysts.

Habben Jansen (pictured above) said major accomplishments in 2018 included achieving synergies from its 2017 merger with United Arab Shipping Co. ahead of time and beginning to implement a new strategy unveiled last November that takes into account its acquisition of both UASC and its 2014 merger with CSAV.

With that strategy, Hapag-Lloyd said it is striving to improve profits, become “number one for quality” and be a global player in the container industry.

Hapag-Lloyd had a net profit of $54 million in 2018, compared to $36 million in 2017. Revenue was $13.6 million in 2018 compared to $11.3 million on 2017.

The company also is rolling out improvements in procurement, focusing on transport services, on which it spends $1 billion per year, on a worldwide basis following a successful pilot in Asia and Europe.

“This is not only about trying to get lower rates, but also trying to get the right modal split and trying to optimize the way we organize the transport,” said Habben Jansen.

The Hamburg, Germany-headquartered carrier also is prioritizing initiatives to reduce empty container moves on which it also spends about $1 billion annually.

Quality initiatives include an effort to increase digital booking of cargo on Hapag-Lloyd’s web channel, currently at 7 percent, and developing new digital services.

Source: World Maritime News, American Shipper, Maersk Website.

.png)

.jpg)