Hapag-Lloyd Boxship Briefly Grounds, Hits Crane in Hai Phong -Vietnam

A Hapag-Lloyd containership has damaged a gantry crane in Vietnam after it briefly grounded, a company spokesperson confirmed to World Maritime News.

The 2010-built Nagoya Express hit ground after departure in Vietnam but managed to pull itself free.

When returning to berth under pilot advice, the 8,600 TEU containership “touched the gantry crane,” according to the German shipping major’s spokesperson.

The company said that it is investigating the causes of the incidents in close cooperation with authorities and insurance.

According to VnExpress, the incident occurred earlier this month during stormy weather. Namely, the vessel was sailing out of the Hai Phong International Container Terminal on June 7 when the mishap occurred, the media outlet cited a spokesperson of the Maritime Administration of Hai Phong.

Data provided by Marine Traffic shows that the ship is currently anchored off Hai Phong.

Yang Ming Adds New Service amid Rising Trade Tensions

Taiwanese shipping company Yang Ming Marine Transport Corp. has revealed changes to its service network amid the rising global trade tensions.

The company said that the impact from the tensions is expected to cause a relocation and adjustment of cargo flow and supply chains.

In order to cope with this trend, Yang Ming plans to strengthen its Asian service network with the launch of a new Intra-Asia service, China-Thailand Service (CTX service).

The first sailing is scheduled for July 12, 2019, departing from Shanghai.

A total of three container ships with loadable capacity of 1,200 TEU will be deployed for CTX service, of which one is contributed by Yang Ming.

The ports of call are Shanghai, Ningbo, Xiamen, Laem Chabang, Bangkok, Laem Chabang, Hong Kong, Shanghai. A round trip will take 21 days.

Msc Wins Best Shipping Line Asia–Africa Award

MSC have won the Best Shipping Line: Asia – Africa category at the prestigious Asian Freight, Logistics and Supply Chain (AFLAS) Awards, underlining the company’s strong position in the region.

The awards are hosted and organized annually by Asia Cargo News to recognize leading logistics and supply chain providers, based on excellence in customer service, innovation and quality of service. This year, they were announced on 17 June at a Gala Dinner and Award Ceremony, held at The Asia Society Hong Kong Centre.

The nomination and voting process allowed the more than 15,000 readers and e-news subscribers to first determine the leading companies in the market, and then determine the winners, making the results the opinion of service users rather than a panel of judges.

'Hyundai Dubai' Rescued All Crew of Norwegian tanker involved in an accident

On June 13, 2019, The HMM vessel ‘Hyundai Dubai’ rescued all 23 crew members of the Norwegian tanker ‘Front Altair’ which encountered an explosion accident in the Strait of Hormuz.

According to the ‘Hyundai Dubai’, the three rounds of explosion occurred at 06:40 a.m. and the captain of the ‘Front Altair’ sent the distress signal with urgency to ‘Hyundai Dubai’, which was passing nearby. In response, ‘Hyundai Dubai’ safely rescued all 23 crew members, including the captain at 07:54 a.m., 74 minutes after receiving the distress signal.

BDO: Shipping Confidence Slightly Down over Trade War Concerns

Confidence in the shipping industry has fallen marginally over the past three months, mainly due to the ongoing concern over trade wars and increased regulation, according to shipping adviser and accountant BDO.

The latest Shipping Confidence Survey showed that the average confidence level in the three months to May 2019 was 6.1 out of a possible maximum of 10.0. This is slightly down on the figure of 6.2 recorded in February 2019.

Confidence was up in Asia, from 5.8 to 6.0, and in North America, from 5.6 to 6.4. In Europe, meanwhile, there was a drop in overall confidence levels from 6.3 to 6.1.

The chartering sector saw an increase in confidence level to 6.2 from 6.0 three months ago. The ratings for owners and managers, meanwhile, were unchanged at 6.3 and 5.8 respectively, while the rating for brokers was down from 5.9 to 5.7.

The likelihood of respondents making a major investment or significant development over the coming year was up from 5.3 to 5.4 out of 10.0. Owners’ confidence in this regard was up from 5.4 to 6.3, while the rating for charterers was 5.6 compared to the survey high of 7.3 recorded last time.

The number of respondents who expected finance costs to increase over the coming year was unchanged at 48%. The figures for owners and brokers were down, but up in the case of charterers and managers.

Demand trends were cited by 26% of respondents as the factor most likely to influence performance over the next 12 months. Competition (19%) and finance costs (13%) featured in second and third place respectively in this context.

The number of respondents expecting higher freight rates over the next 12 months in the tanker market was up by 4 percentage points on the previous survey to 55%, with charterers (75%) leading the way. In the dry bulk sector, expectations of rate increases were down overall from 52% to 48%, with charterers the only category recording an increase in expectation levels. The numbers expecting higher container ship rates, meanwhile, rose by 9 percentage points to 35%.

“A small dip in confidence is not surprising given the recent volatility generated by the US-China trade wars, the heightened tension in the Arabian Gulf, the failure to conclude Brexit negotiations, and general political instability in many parts of the world. Markets love volatility, but it can have an adverse effect on confidence,” Richard Greiner, Partner, Shipping & Transport, said.

“Despite the challenges the industry is facing, there are a number of positive indicators. New technology is making shipping more attractive to investors, and will moreover act as a trigger to accelerate the pace and extent of recycling. Higher freight rates should logically follow, and those who hold their nerve will ultimately benefit.”

Maritime transport will be affected by rising costs due to fuel regulations

Assessing the operation and direction of maritime transport in the second half of the year, many enterprises said that the US-China trade war is helping increase Vietnam's export and import goods. However, many businesses are also worried about shipping companies switching to clean fuels from the beginning of next year. This is forecast to push transportation costs up.

Growth is not as expected

According to Vietnam Maritime Administration, in the first quarter of 2019, Vietnam's seaports system received more than 128 million tons of goods, an increase of 7% compared to the same period in 2018, of which container cargo reached nearly 4.1 million TEUs. The above result is due to Vietnam’s increase in import and export turnover. Specifically, in the first quarter, export turnover reached US$58.51 billion and import turnover reached nearly US$58 billion, up 4.7% and 8.9%, respectively, over the same period last year.

Forecasting cargo through seaports in the future, Mr. Trinh The Cuong, Head of the Maritime Transport and Service Department (Vietnam Maritime Bureau), said that the volume of goods transported through seaports in the near future will continue to maintain the growth rate as a series of large shipping lines such as Maersk and SITC willcontinuously open more service lines at seaports in Hai Phong, Da Nang and Cai Mep - ThiVai.

In Q1/2019, it recorded total revenue from production and business activities atnearly VND2,900 billion, while profit reached VND 46 billion of Vietnam Maritime Corporation (Vinalines). In particular, the volume of sea transport is estimated to reach more than 5.2 million tons andthe output of containers is about 74,000 TEUs. The port sector has a throughput volume of nearly 24 million tons (up 24% compared to the same period in 2018), volume of containers reached more than 1,150 TEU (up 42.1% over the same period).

However, according to some maritime transport enterprises, revenue in the first quarter of 2019 was not as expected. Specifically, according to Mr. Nguyen Hanh Phuc, Head of Services and Import and Export of Tai Phat Cargo Services Co., Ltd., Q1/2019 profit of the Company is 25-30% lower than that of the first quarter of 2018. The main reason pointed out by Mr. Phucis that the number of ships of foreign transport enterprises has continuously increased in recent years. Along with that, the fact that foreign transport enterprises expanded more new flights in Asia also causeddomestic enterprises to face fiercer competition.

Worries about increasing costs from 8-12%

“Most small transport businesses usually operate in intra-Asia routes, while foreign transport enterprises with large, heavy-duty fleets are much more competitive than Vietnamese transport firms. It is very difficult for Vietnamese enterprises to compete on price. Therefore, besides the orders that we signed and made contracts from the end of 2018, we did not get any new orders for the first 5 months of this year. In the following months, we determined that we will cooperate with three more carriers to increase our flights to reduce costs, thereby creating more competitiveness for orders,” Mr. Nguyen Hanh Phuc said.

Talking to reporters from Customs News, Ms. Bui Phuong Thao, Deputy Director in charge of Import and Export Department (ports), Thien Hoa Forwarding Transport Service Trading Co., Ltd said in the coming months the company has determined that they will face many difficulties because according to the announcement of the International Maritime Organization (IMO), from the beginning of 2020, all shipping companies must comply with the regulations on minimizing sulfur in fuel from 3.5% to 0.5% to reduce emissions. The compliance with this regulation will affect shipping rates, especially at the end of the year when the volume of import and export goods is higher.

“Some shipping lines have announced about adjustments of BAF fuel surcharges, in particular to increase from US$70-100/TEU on some routes, according to our calculations, this will increase shipping fees by 8-12%. So surely our revenue will also be affected. While supply is increasing, the number of foreign shipping lines is increasing. Notably, import and export goods are now designated by foreign partners, so the competition on the remaining orders is even fiercer”, said Ms. Phuong Thao.

MSC temporarily suspended from C-TPAT after drug bust

The US government has temporarily suspended Mediterranean Shipping Co. from a US Customs Service program allowing reduced screening for certified parties after more than 16 tons of cocaine were seized from containers shipped by the carrier to the Port of Philadelphia.

The 90-day suspension of MSC from the Customs-Trade Partnership Against Terrorism (CTPAT) means the container line will no longer enjoy “trusted trader” status, increasing the likelihood of shipment delays. In a Tuesday statement, Geneva-based MSC said the company is working with authorities to improve supply chain security and noted that “shipping and logistics companies are from time to time affected by trafficking problems.”

In a Thursday e-mail to customer, MSC said to "expect minimal disruption as a result of the C-TPAT certification issue. For example, there could possibly be additional inspections on certain containers coming from South and Central America to the USA. There will be no impact on customs clearance for cargo, which is flowing regulary in and out of USA."

US authorities have charged six crewmembers of the MSC Gayane after the Monday seizure of 16.5 tons of cocaine with an estimated street value of $1.1 billion. Although six people were charged, court records only identified Ivan Durasevic and Fonofaave Tiasaga as being in custody, according to a Philadelphia CBS report

During a Friday briefing, US Attorney William McSwain said each defendant was “federally charged with one count of knowingly and intentionally conspiring with each other and with others to possess more than five kilos of cocaine on board a vessel subject to the jurisdiction of our country.” According to court documents, Durasevic said he brought cocaine onto the vessels after the chief officer offered him $50,000.

“According to Durasevic, upon leaving Peru on this current voyage, he got a call from the chief officer to come down to the deck, at which time he saw nets on the port side stern by the ship’s crane. Durasevic and approximately four other individuals, some of whom were wearing ski masks, assisted in the pushing of the nets towards Hold Seven or Eight of the vessel. The nets contained blue or black bags with handles. Two or three crew members assisted in loading the cocaine into containers. The whole process took approximately 30 to 40 minutes,” according to court documents cited by Philadelphia CBS.

The latest drug bust involving an MSC vessel comes after a joint US task force found 1.5 tons of cocaine in containers discharged from the MSC Carlotta on Feb. 28 at the Port of New York and New Jersey; Peruvian authorities discovered another 2.4 tons when the ship called in Callao just two months later. In January, Mexican customs officials seized cocaine on the cruise ship MSC Divina during a stop in Cozumel.

MSC said it is working with authorities to restore C-TPAT certification prior to the expiration of the temporary suspension. The company, one of the first container lines to join the program when it began, said it would continue to meet the requirements of the program.

"MSC will continue to collaborate with authorities worldwide, to ensure our vessels are secure and can deliver our customers’ cargo safely and reliably," the carrier told customers.

The expanded reach of C-TPAT

The decision to suspend MSC’s C-TPAT membership shows how a program that was originally created as part of the post-9-11 anti-terrorism regime (the program came into being just a few months after the attacks), has been increasingly expanded to include non-terrorism-related contraband especially narcotics, according to those familar with the program.

C-TPAT is a voluntary program and has been joined by thousands of shippers, carriers, and non-vessel-operating common carriers who commit to maintaining a safe supply chain and submit to periodic audits in return for receiving a lower risk score on their shipments, which would result in fewer inspections and cargo delays. There is a tangible benefit to that beyond supply chain disruption because inspections result in added costs to the shipper both for the inspection itself and any detention and demurrage costs that result.

In the case of a carrier like MSC, losing its C-TPAT privileges could raise questions as to who is responsible for costs related to any additional inspections on its customers’ cargo. That could get contentious, as it will unlikely be transparent as to why Customs decided to inspect a given container; was it related to MSC losing its C-TPAT privileges, was it because of the shipper, or was the container randomly selected?

Alliance member impact?

Like most global container carriers, MSC often transports cargo on behalf of slot purchasers under various vessel-sharing agreements. Maersk Line, MSC's partner in the 2M Alliance and a C-TPAT member, said in a customer advisory Wednesday it "does not expect any impact to operations short term," adding that "all current port calls and operations are proceeding with no delays."

"Maersk vessels are not facing any issues in US ports today — it is business as usual," the carrier said.

Whether the supension might result in delays for cargo being transported on MSC ships on behalf of Maersk and other slot purchasers such as HMM, however, however, is not yet clear.

Customs maintains C-TPAT-verified importers are three-and-a-half times less likely to have their shipments examined by the agency and seven times less likely to see their cargo go through extensive examination. Trusted traders are also eligible for priority treatment during major supply chain disruptions.

MSC transported just over 3 million TEU of US import cargo in 2018, according to data from PIERS, a sister product of JOC.com within IHS Markit, making it the third-largest carrier in the trade with 12.3 percent of the market.

Spot rates, volume declines leave trans-Pac carriers one option

With trans-Pacific eastbound spot rates falling for a third straight week, China imports declining, and time running out for a beat-the-tariff import surge, container lines have only one option to prevent the loss of peak season gains: more blank sailings.

Container lines have already announced three blank sailings for June. A blank sailing occurs when a carrier or a vessel-sharing alliance cancels a regularly scheduled weekly sailing, something they did with regularity last year during slack periods. Carriers demonstrated earlier this year that pulling capacity when cargo volumes soften was still in their playbook as they blanked 35 sailings in February and March in the trans-Pacific.

“We expect an uptick in voided sailings in July, and a further uptick in August,” Blake Shumate, COO at American Global Logistics, said Friday.

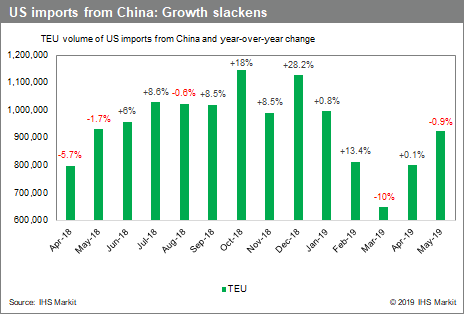

Containerized imports from China have already dropped 6 percent through April, according to PIERS, a JOC.com sister company within IHS Markit. Further declines are likely because of the ongoing US-China trade war that began in the summer of 2018 with the Trump administration’s announcement of 10 percent tariffs on imports from China. Additional tariffs of 25 percent followed earlier this year. The next round of tariffs on the remaining $300 billion of imports from China is likely to take effect later this summer unless next week’s meeting between US President Donald Trump and President Xi Jinping of China at the G 20 summit in Tokyo can put an end to the trade war.

However, as the eastbound Pacific prepares to enter the summer-fall peak season, carriers are keeping their options open for rate increases by giving the required 30-day notice for planned general rate increases. Hapag-Lloyd, for example, announced this week a GRI of $480 per TEU and $600 per FEU effective July 20. It is common for carriers to announce GRIs at this time of year, although coming so early in the season, carriers normally don’t achieve the full rate increase that they post.

In addition to managing capacity with planned blank sailings, the likelihood of ad-hoc blank sailings in the fourth quarter is emerging as carrier dry dock vessels for about a week to flush high-sulfur fuel from the tanks and refill them with low-sulfur bunkers ahead of the Jan. 1, 2020 deadline for global implementation of the International Maritime Organization’s low-sulfur fuel requirement.

Although both beneficial cargo owners (BCOs) and carriers anticipate imports this year will be down significantly from the 15.5 percent increase in imports from Asia in the fourth quarter of 2018, carriers appear determined to prop up spot rates through strict capacity management.

In the June 16 Sea-Intelligence Sunday Spotlight, Alan Murphy, co-founder and CEO of Sea-Intelligence, said spot rate erosion in the eastbound trans-Pacific has continued rather steadily since the Shanghai Containerized Freight Index (SCFI) peaked on Nov. 2, 2018 at $2,606 per FEU to the West Coast and $3,739 per FEU on Nov. 16 to the East Coast. The SCFI, which is published in the JOC.com Shipping and Logistics Pricing Hub, on Friday listed the West Coast spot rate at $1,382 per FEU, down 2.4 percent from last week, and the East Coast rate at $2,404 per FEU, also down 2.4 percent.

Managing capacity is critical

Spot rates in the past almost always increased during the August-October peak season, so the forecast of softening imports in the second half of the year leaves carriers with only one option to avoid a sharp decline in freight rates — managing capacity, Murphy said. “If the current erosion levels continue, any gains in the peak season would be lost in a matter of weeks,” he said.

Commenting on the likelihood of more tariffs, Eytan Buchman, CMO of Freightos, stated in Tuesday’s newsletter that “US Secretary of Commerce Wilbur Ross said the administration would be ‘perfectly happy’ to apply tariffs on remaining untaxed Chinese imports.”

In letters to US Trade Representative Robert Lighthizer, West Coast port directors said the tariffs already in effect, and the uncertainties surrounding a further round of tariffs, are devastating to the imports and exports at their gateways, which are tightly linked with China.

Gene Seroka, executive director of the Port of Los Angeles, said the Los Angeles-Long Beach gateway handles close to 40 percent of US containerized imports, and China is by far the largest source, representing about 64 percent of the gateway’s imports by TEU volume. China accounts for more than one-third of Oakland’s containerized imports and exports, said Chris Lytle, executive director of the Port of Oakland. Both importers and exporters in Northern California say the tariffs and threat of additional tariffs are playing havoc with their international supply chains, he said.

Importers are already shifting whatever production they can from China to factories in Vietnam and other Southeast Asian countries, but “repositioning of manufacturing will take time,” Shumate said. Additionally, carriers are indicating their preparedness to increase vessel strings from Southeast Asia to the US, but time is running out. Back-to-school merchandise is already beginning to enter the country so that it will be on store shelves by early August, he said.

Shumate said that although peak season holiday merchandise has not yet begun to move, it has been difficult getting accurate forecasts from BCOs about their “desired” production schedules in Asia and their “true” production schedules. This makes peak-season forecasting in terms of actual volumes, and source countries, difficult to ascertain, he said.

Fast-forwarding peak-season shipments also involves choosing a US gateway either on the West Coast or East Coast, as well as warehouses needed to hold the merchandise until it is ready to be shipped to stores, Shumate noted. Warehouses in Southern California are already beginning to fill up, so importers are looking to nearby states for storing merchandise destined for the West. Importers in the eastern half of the country are looking more closely at warehouses in the Midwest, which can be reached either through West Coast or East Coast ports, he said.

While these uncertainties are causing headaches for the logistics managers at retailers and manufacturers, carriers appear to be in the driver’s seat when it comes to ensuring that a disappointing peak season in terms of cargo volume does not translate to a further erosion of freight rates. Carriers learned their lesson well last fall and earlier this year, Murphy stated.

“Carriers culled significant amounts of capacity in 2018-Q4 and 2019-Q1, with near historical highs [if not the highest] number of blank sailings in the last quarter of 2018,” he said.

Carriers will have yet another option for managing capacity in the fourth quarter when it comes time to take vessels out of service ahead of the shift to low-sulfur fuel. A planned one week out-of-service time for the transition could easily extend to two weeks. If import volumes weaken in the fourth quarter, “why wouldn’t they?” extend the layup period, Shumate said.

Intra-Asia slowdown spells gloom for east-west trades

Container volumes declined on the intra-Asia trade in the first quarter of 2019, which under normal circumstances would be a sign of decreasing orders for manufactured goods and a barometer of demand on the major east-west routes.

But with shippers starting to rush shipments to avoid tariffs threatened in May on the remaining $300 billion in US imports of Chinese goods, the trade situation is anything but normal, at least on the trans-Pacific. Without the exigent demands of tariffs, the impact of a slowing intra-Asia on Asia-Europe volume is a concern that is heightened by the surplus capacity in the trade.

While intra-Asia volume fell just 0.2 percent, BIMCO noted in its latest container shipping report the weakening trend was a result of fewer new export orders being received by Asian factories in recent months — something that will impact outbound volumes.

“Fewer export orders mean less transport of semi-finished goods between the Asian countries,” Peter Sand, BIMCO chief shipping analyst, said in the report.

“So the freight rates on intra-Asian routes going from Shanghai to Japan, Korea, and Singapore are increasingly relevant to keep an eye on, to spot the knock-on effect on the regional semi-finished goods market, and they are mostly moving sideways or slowly in decline.”

Asian manufacturing slowdown

According to the IHS Markit Purchasing Managers' Index (PMI), global manufacturing output has been contracting since February and in April hit a six-year low of 50.3. May survey data for the Nikkei Association of Southeast Asian Nations (ASEAN) Manufacturing PMI signaled a sustained downturn in the global automobiles and auto parts sector, with output falling for the eighth month running, along with new orders. Purchases of supplies by makers of automobiles and auto parts contracted at the fastest rate in nearly seven years.

IHS Markit’s ASEAN survey found five other sectors registering lower output in May, all manufacturing related, except for real estate. The most notable in this group were industrial goods and metals and mining, where production declined for the fifth and eighth successive months, respectively.

How this will impact the major east-west trades remains to be seen. Asia-Europe volume data from Container Trades Statistics is only available for the January through April period, when volume increased 7 percent year over year to 5.47 million TEU. April volume was up 13 percent compared with the same month last year.

For the trans-Pacific, the US-China trade dispute is making forecasting tricky. In the first five months of the year, US imports from China are down 4.6 percent and total Asia imports are up just 1.8 percent, but there are expectations of another wave of front-loading to avoid the next round of US tariffs on Chinese-made goods and increased fuel costs related to the International Maritime Organization’s (IMO’s) low-sulfur fuel mandate, IMO 2020.

Still, even with US imports from China contracting, three container line executives told JOC.com they don’t expect the impact of higher tariffs — an increase to 25 percent from 10 percent on $200 billion of Chinese imports — to fully hit US consumer demand until 2020.

“I don’t see anything indicating a huge drop-off. It’s business as normal,” said George Goldman, president of Zim Integrated Shipping Services.

At the other end of the spectrum, credit insurance agency Atradius Asia wrote in a recent report that international trade growth would remain muted in 2019 and 2020, and that further escalation of the simmering trade tensions between the US and China was not only a realistic possibility but one that would “spell disaster” for global trade.

Atradius noted that after the May tariff threat, the chances of an agreement putting an end to the tit-for-tat tariffs had plummeted. “A new truce could be agreed between President [Donald] Trump and President Xi Jinping at the G-20 summit in Japan on June 28 and 29,” the firm wrote. “However, this remains highly uncertain and even if one is reached, it is not likely to remove the tariffs that are already in place.”

Carrier capacity discipline

As the analysts struggle with demand forecasts, the supply of capacity is more predictable. BIMCO expects the global container shipping fleet to grow 3.1 percent in 2019, the second-lowest fleet growth on record.

While that is a positive for carriers, the capacity overhang differs by trade. Maritime consultant SeaIntelligence noted in a report released this week that the combined Asia-North Europe and Asia-Mediterranean weekly capacity in weeks 22 to 30 (May 27 to July 28) will grow 4.1 percent year over year, the second-highest in the 2012 to 2019 period.

It is a very different capacity picture on the Asia-US trades. SeaIntelligence reported that from late May through late July, eastbound capacity to the US West Coast will be 0.3 percent lower than the same period a year ago, while capacity to the US East Coast will expand just 1.7 percent in the same period.

“Seemingly, for much of this year, carriers have been doing their part, showing strong capacity discipline,” Alan Murphy, co-founder and CEO at SeaIntelligence, told JOC.com.

The question is what this supply-demand imbalance will do to freight rates. On Asia-Europe, carriers will likely struggle to push rates up through the peak season. Edoardo Podestá, managing director, air and sea logistics, Asia Pacific, for Dachser Far East, predicts a sharp decline in rates through September and for the rest of the year.

Podestá is expecting a slight pickup in rates from now to the end of July, but after that, “it will be a bloodbath,” he told JOC.com. “Some carriers may have been lucky in their rate discussions with BCOs [beneficial cargo owners] last year, but it will be bad. Rates will survive the summer, but I am expecting a very big drop after that.”

Asia-North Europe rates on the Shanghai Shipping Exchange’s Shanghai Containerized Freight Index (SCFI) have been stuck below $800 per TEU since late February and are currently down 10 percent year over year. The weekly rate movements are tracked at the JOC Shipping & Logistics Pricing Hub.

On the trans-Pacific, the spot rate to ship an FEU from China to the US West Coast — a barometer of how supply is stacking up with demand — has stayed above $1,300 since March and is up more than 5 percent from a year ago, according to the June 6 reading of the SCFI.

At $1,439 per FEU, rates from China to the US West coast are up 6 percent year over year but have declined almost $1,200 per FEU since hitting a 12-month high last November — a 45 percent drop. On the China-US East Coast trade, the rate of $2,502 per FEU is 33 percent below a high of $3,739 per FEU recorded in November.

Sand concluded that just as container shipping margins reached positive territory, the balance was tipping and another downturn had begun. He noted fleet management by ship owners and operators, more than the changes in demand for container shipping, was the trigger for these cycles.

“During 2011 to 2018, the main container carriers posted an average operating margin that was negative in 19 out of 32 quarters,” he said. “As BIMCO forecasts weak demand growth for the coming quarters, the container shipping industry is set to return to negative margins.”

Source: World Maritime News, Seatrade Maritime, American Shipper, VN Customsnews, JOC.com

.png)

.jpg)