OOCL Boxship Giant Hong Kong on Maiden Visit to Namesake City

OOCL Hong Kong, once the world’s largest boxship, arrived at the Port of Hong Kong on July 25 for its maiden visit to the namesake city.

The containership serves the Asia-Europe trade lane on the LL1 service and will head for the Port of Shanghai following the Hong Kong call.

The lead ship of the six G-class units visited Hong Kong on the 50th anniversary of Orient Overseas Container Line (OOCL).

“This is truly a milestone event for us at OOCL because the last time we welcomed a vessel with the same name in Hong Kong was back in 1995 which coincided with our company’s 25th anniversary,” Andy Tung, Co-Chief Executive Officer of OOCL.

Delivered by Samsung Heavy Industries in 2017, OOCL Hong Kong was the largest containership of its type ever built at the time, with a capacity of 21,413 TEU.

It is now surpassed by the Daewoo Shipbuilding and Marine Engineering-built MSC Gulsun, which is the first of a series of six 23,000 TEU units.

be a part of the action in providing that vital link to global trade over the last fifty years.

The OOCL Hong Kong and her sister vessels, will continue to make regular calls to Hong Kong on our Asia-North Europe Loop 1 (LL1) service and her port rotation is: Shanghai / Ningbo / Xiamen / Yantian / Singapore / via Suez Canal / Felixstowe / Zeebrugge / Gdansk / Wilhelmshaven / Piraeus / via Suez Canal / Port Kelang / Hong Kong / Shanghai in a 77-day round trip.

Vessel Particulars | |||

Length overall | 399.870 meters | Air Draft | 73.5 meters |

Length BP | 383.0 meters | Deadweight | Approx. 191,317 metric tons |

Breadth (Mld) | 58.8 meters | Container Carrying | 21,413 TEU |

Depth (Mld) | 32.5 meters | IMO Number | 9776171 |

Designed Draught | 14.5 meters | Official Number | HK- 4755 |

Scantling Draught | 16.0 meters | Call Sign | VRQL9 |

COSCO SHIPPING Ports has reportedly entered into a merger agreement with Tianjin Port Holdings and China Merchants International Terminals.

Under the agreement, the three groups will merge their Tianjin container terminal assets, Tianjin Port Container Terminal Company (TCT), Tianjin Five Continents International Container Terminal Company (FICT) and Tianjin Orient Container Terminal Company (TOCT), stated Splash.

Upon completion of the merger, TCT will be the entity to absorb all assets, credits, debts and employees of FICT and TOCT.

COSCO believes that the merger will optimise the allocation of resources, enhance the unified management of the relevant terminals and lower operational costs.

Port Strategy has contacted COSCO for comment.

2M keeps Asia-Europe sailings while rivals cut

There is still no sign of blank sailings on the Asia-Europe trade from the 2M Alliance, despite its two rival alliances cutting 7 percent of total weekly capacity since the beginning of July.

The removal of more than 130,000 TEU from the trade in July and August has focused attention on the 2M grouping of Maersk Line and Mediterranean Shipping Co., but when asked if the alliance has any plans to cut sailings, a spokesperson for Maersk told JOC.com, “2M does not plan any blanked sailings in July and August. We constantly review our service network to meet our customers’ increasing need for reliable cargo delivery and took steps to adapt to any external factors earlier this year.”

That is in stark contrast to 2018 when an entire service was suspended, a point made by Alphaliner. 2M suspended its AE-2/Swan service for a total of 12 weeks from September to early December last year, which the container shipping analyst said helped to stabilize freight rates in the face of slower demand growth. The Asia-Europe spot rate during those 12 weeks remained relatively flat, moving within a narrow range of $26 per TEU.

Latest blanking from Ocean Alliance

Another blank sailing for August was announced this week by the Ocean Alliance, canceling the FAL1 service leaving Tianjin on Aug. 15. FAL1 operates with 12 vessels between 16,022 and 20,954 TEU, and the blanking brings to five the total number of sailings canceled by the alliance in July and August.

THE Alliance has announced four sailings will be blanked over July-August, and HMM will blank its independently operated AEX service over the period. One of THE Alliance services affected is FE2, the largest Asia-Europe loop offered by the group, deploying 12 ships averaging 19,000 to 20,000 TEU in capacity, Alphaliner said. Another is the FE5, which uses 10 ships of 13,000 to 14,000 TEU.

The total of nine blanked sailings will remove more than 130,000 TEU from the Asia-Europe trade at a traditionally busy part of the year, an indication of low carrier expectations for the peak season.

This weakness in demand was supported by an observation made by Kuehne + Nagel CEO Detlef Trefzger during the forwarder’s first-half results announcement July 23.

“There is no sign of a peak season, for either air or ocean freight. We have a normal seasonality, but no hard push for higher demand that would come from a peak season,” Trefzger said.

Asia-Europe rate slump

Further support for the weak outlook can be found in spot rates on the Shanghai Containerized Freight Index (SCFI), managed by the Shanghai Shipping Exchange, that have fallen by more than 30 percent since the start of the year. The JOC Shipping & Logistics Pricing Hub tracks the weekly movement of the SCFI, and data show the spot rate has lost $324 per TEU since early January.

With such a dramatic decline, Alphaliner said that carriers’ blank sailing programs on the route have so far not been enough to stop the rate slump.

While canceled sailings are not nearly as disruptive as rolled cargo, which happens with no notice, it is still a practice disliked by shippers. The supply chain director for a European retailer shipping 5,000 TEU a year said he needed sailing information three to four months out because that was when orders were placed and everything flowed from that.

He said blank sailings were hard to manage, but the way his group’s supply chain was set up, he had no alternative but to ship by ocean. However, blank sailings and poor ocean reliability are making him look very closely at China-Europe rail and how to make more use of it.

A Europe-based manufacturer with annual tenders for 25,000 TEU said blank sailings were not easy for shippers to control and extremely disruptive.

“Often we find out a sailing has been canceled too late and that puts the shipment back a week. Having a multi-carrier strategy used to be a way to cope with blanked sailings, but with only three alliances that is now more difficult,” he said.

The IHS Markit/Caixin China General Manufacturing Purchasing Managers’ Index (PMI) in June slid to its second-lowest since June 2016, indicating a clear contraction in the manufacturing sector. It was equally uncertain at the other end of the Asia-Europe trade where the IHS Markit Eurozone Manufacturing PMI revealed that operating conditions in Europe deteriorated for a fifth successive month during June. JOC is a unit of IHS Markit.

OOCL reports 7% revenue increase

Transpacific liftings were down 0.6% but revenue rose 6% in the same trade lane.

Hong Kong-based Orient Overseas Container Line (OOCL) said it had revenue of nearly $1.57 billion in the second quarter of 2019, 7.1% more than in the same period last year. In the first half of this year, revenue amounted to nearly $3.03 billion, 6.5% more than in the first half of 2018.

According to OOCL’s quarterly operational update, the company handled nearly 1.77 million TEUs of containerized cargo in the second quarter this year, 4.6% more than in the second quarter of 2018. In the first half of 2019, it handled more than 3.37 million TEUs, an increase of 3.2% over the first half of 2018.

OOCL said in the transpacific it carried 502,507 TEUs in the second quarter of 2019, 0.6% fewer than in the second quarter of 2018, but revenue in the transpacific was $622 million in the second quarter of 2019, a 6% improvement over the second quarter of 2018.

In the transatlantic, OOCL’s revenue and liftings in the second quarter of 2019 were sharply higher than in the same period last year. The company moved 123,472 TEUs in the transatlantic trade, a 16.3% increase, and revenue was $154 million, a 23.9% increase.

OOCL reported that in the second quarter of 2019 it lifted 366,575 TEUs in the Asia-Europe trade, an increase of 9.4% over the same period the prior year, while in the intra-Asia/Australasia trade, it handled 776,294 TEUs, a 4.3% increase.

Second-quarter revenue in the Asia-Europe trade was up 1.9% year-over-year to $308 million, and second-quarter revenue in the intra-Asia/Australasia trade was up 7.5% year-over-year to about $482 million.

Earlier this week, the 21,413-TEU OOCL Hong Kong made its maiden call to the Port of Hong Kong. The OOCL Hong Kong and her sister G-Class ships will continue to make regular calls to Hong Kong on the company’s Asia-North Europe Loop 1 (LL1) service, which has a port rotation of Shanghai – Ningbo – Xiamen – Yantian – Singapore – via Suez Canal – Felixstowe – Zeebrugge – Gdansk – Wilhelmshaven – Piraeus – via Suez Canal – Port Kelang – Hong Kong – Shanghai in a 77-day round trip.

Also this week OOCL announced that because of an expectation of low demand in the market, it was canceling several Asia-Europe sailings in August, September and October as detailed here.

Companies affiliated with COSCO (HKEX:1919) acquired a 75% interest in OOCL’s parent company, Orient Overseas (International) Ltd. (HKEX:316), last year. The combined firms are ranked as having the third-largest active containership fleet in the world by Alphaliner.

Like a phoenix the Maersk Honam set to return to service

he heavily fire damaged containership Maersk Honam is set to return to service under a different name having had new bow section and deck house fitted.

Analyst Alphaliner reported in its weekly newsletter that the vessel was set to return to service soon as the Maersk Halifax having been refurbished at Hyundai Heavy Industries.

The 2016-built, 15,262 teu Maersk Honam was hit by a serious fire on 6 March last year 900 nm southeast of Salalah, Oman. Five crew members lost their lives in the fire which took well over a month to be fully extinguished and damaged the bow of the vessel beyond repair.

Following the fire the vessel was towed to the UAE where the fire damaged bow and deck house were removed at the Drydocks World Dubai. In February this year the largely undamaged aft section, including the engine room, was then floated onto a Cosco Shipping heavy lift vessel Xin Guang Hua (pictured above) and shipped to HHI in South Korea.

A new bow and deckhouse have been built at HHI and connected to the original aft section of the Maersk Honam.

According to Alphaliner in the process the bow was reshaped from the original vessel and scrubber added to meet the requirements of the IMO sulphur cap.

The analyst said the vessel would return to service as the Maersk Halifax on the Asia - Med 'AE11/Jade' service of the 2M from Maersk and MSC on 5 August.

The fire on the Maersk Honam was believed to have stemmed from a misdeclared dangerous cargo, and issue which have become major problem for the container shipping industry.

New CEO for APL as carrier readies Asia-Europe exit

The priorities of APL’s new CEO Stéphane Courquin will be to consolidate long-haul trans-Pacific routes and develop intra-Asia as the carrier withdraws from the Asia-Europe trade in the fourth quarter.

APL parent CMA CGM announced Friday that Courquin will take over leadership of the Singapore-based carrier from Lars Kastrup, who has only been in the position since Jan. 1 this year. A CMA CGM statement said Kastrup was leaving “to pursue another career opportunity.”

Courquin, currently head of CMA CGM’s Middle East office, will be the third CEO since CMA CGM acquired APL in July 2016. Following the takeover, the French line replaced Ng Yat Chung with Nicolas Sartini as CEO. Sartini was appointed deputy CEO of CEVA Logistics following its takeover by CMA CGM last year and has subsequently moved up to CEO of CEVA.

With access to the network of the world’s third-largest carrier, the financial fortunes of APL began to quickly improve. In 2017, APL contributed strongly in its first full financial year as a subsidiary of the French container shipping group, helping CMA CGM report record revenue and almost 19 million TEU, a year-over-year increase of 21 percent. APLcontributed 5 million TEU to group volume. It reversed a string of annual losses at the carrier.

Trading places

The replacement at the top of APL, and the trans-Pacific and intra-Asia focus of the new CEO, come as CMA CGM prepares to pull its subsidiary from Asia-Europe by Oct. 1, a trade that it serves as a member of the Ocean Alliance.

APL will instead build on its expanding intra-Asia business, working in cooperation with CMA CGM regional specialist CNC. But profitability on the hypercompetitive intra-Asia is difficult to find — a regional carrier executive told JOC.com that the logistics cost of loading a box on a ship was often not even covered by the rate — and many routes are seen as loss leaders, with the regional network also serving to position containers for pick up by mainline vessels calling at Asia’s hubs.

The Asia-North America focus of APL includes its guaranteed suite of premium services that the carrier has been offering shippers on the trans-Pacific for the past few years.

Eagle GO. Guaranteed targets shippers willing to pay premium rates for a faster and guaranteed service that provides a complete refund if the ocean carrier fails to meet the delivery date. During the front-loading chaos of peak season 2018 ahead of United States tariffs on China, Jesper Stenbak, APL senior vice president for trans-Pacific trade, said the service brought supply chain certainty to shippers battling to find space or avoid rolled cargo.

The guaranteed option was subsequently expanded to Asia-Europe, giving shippers of time-sensitive cargo guaranteed space on 13 Europe-bound services from 27 Asia ports. There is no indication yet from CMA CGM whether it will continue the premium service once APL withdraws from the trade.

CMA CGM has been energetically upping its presence in the container shipping and logistics market, in June acquiring Containerships as another regional subsidiary that joins CNC in intra-Asia, Mercosul in Brazil’s domestic container shipping market, Sofrana in the Pacific Islands regional maritime trade, and MacAndrews.

The Containerships takeover was made just two months after CMA CGM bought a 25 percent stake in logistics provider CEVA, furthering a development strategy implemented by chairman and CEO Rodolphe Saadé aimed at densifying the group’s regional network.

OOCL to launch new East India to North Europe service

Orient Overseas Container Line (OOCL) will introduce a new Middle East/Indian Subcontinent – North Europe Service (IP3) as an extension of its North Europe service network to the East Indian Subcontinent.

The IP3, to be launched in October this year, will be the only dedicated East India to North Europe service in the market, according to OOCL.

“It provides extensive coverage of India’s East Coast and direct linkage between the Middle East, India, Sri Lanka, Egypt, Greece, Netherlands, United Kingdom, Germany, Belgium and France. It also offers more competitive and reliable services than transhipment options,” OOCL stated.

The first sailing will begin from India’s Vizag on 27 October 2019.

The port rotation will be Vizag, Krishnapatnam, Chennai, Tuticorin, Colombo, Cochin, Damietta, Piraeus, Rotterdam, London Gateway, Hamburg, Antwerp, Le Havre, Damietta, Jeddah, Colombo, and back to Vizag.

Unexpectedly trade deficit hits nearly 700 million USD in the first half of July

VCN – After a trade surplus of 1.93 billion USD in June, Vietnam suddenly has a trade deficit of nearly 700 million USD in the first half of July.

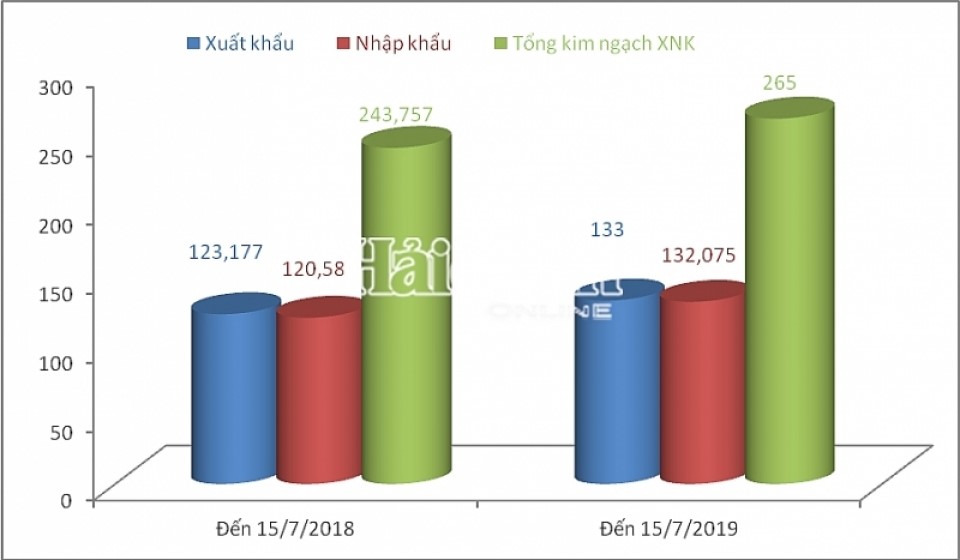

Development of import and export turnover to July 15, 2018 and 2019, units ‘billion USD‘. Chart: Binh

According to the General Department of Customs, in the first 15 days of July, total export turnover reached 10.504 billion USD and import value reached 11.183 billion USD.

Thus, trade balance in the first 15 days of this month has trade deficit of nearly USD 700 million.

Because the trade surplus in June still reached a high level of nearly 1.6 billion USD, accumulated from the beginning of the year to July 15, Vietnam still has an export surplus of over 900 million USD.

In the early days of July, Vietnam's trade balance has been fluctuating and not following rules of many years.

In the first half of July, the largest export turnover groups were mobile phones and components with 1.717 billion USD; textile reached 1.55 billion USD; computers, electronic products and components reached 1.421 billion USD.

From the beginning of the year to July 15, total export turnover of the whole country reached 133 billion USD, up 8 percent over the same period last year, an increase of 9.8 billion USD.

The largest groups of export products are still three familiar names as mentioned above.

Specifically, telephones and accessories reached 25.2 billion USD; textile reached 16.6 billion USD; computers, electronic products and components reached 16.94 billion USD.

For imports, the highest turnover groups were computers, electronic products and components with 2.329 billion USD; machinery, equipment, tools and other spare parts reached USD 1,585 billion; phones and accessories reached 622 million USD; fabrics of 572 million USD; iron and steel of all kinds 426 million.

From the beginning of the year to July 15, the total import turnover of Vietnam was 132.075 billion USD, up by 9.5 percent compared to the same period of 2018, marking an increase of 11.5 billion USD.

To July 15, the scale of export and import turnover of Vietnam reached more than 265 billion USD.

Source: World Maritime News; Seatrade maritime; Seanews; Americanshipper; VN Customs News

.png)

.jpg)